Toronto, Ontario — (Newsfile Corp. – August 6, 2024) – Dexterra Group Inc. (TSX: DXT)

Highlights

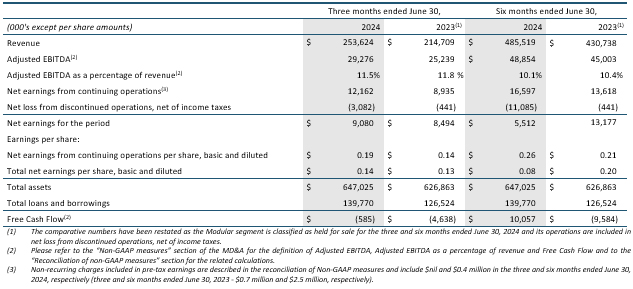

- The IFM and WAFES business units generated strong results for Q2 2024 with consolidated revenue of $253.6 million, an increase of 18.1% compared to Q2 2023 and an increase of 9.5% compared to Q1 2024. The increase in Q2 2024 was primarily driven by strong natural resource market activity levels in WAFES and the full quarter inclusion of the CMI Management LLC (“CMI”) acquisition which closed at the end of February 2024;

- Q2 2024 Adjusted EBITDA, which excludes the impact of discontinued operations, was $29.3 million compared to $25.2 million and $19.6 million for Q2 2023 and Q1 2024, respectively. The increase from the same period last year and last quarter was due primarily to improved IFM margins, strong workforce accommodations occupancy, and high camp equipment and access matting asset utilization.

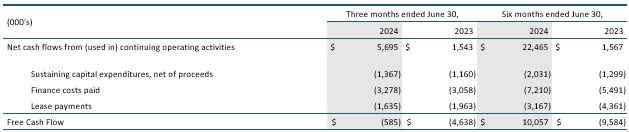

- For the three months ended June 30, 2024, Free Cash Flow (“FCF”) improved compared to the same quarter in 2023. FCF on a year to date basis in 2024 is in line with expectations at $10.1 million and reflects the normal seasonal fluctuations from higher working capital requirements in the first half of the year. Adjusted EBITDA conversion to FCF is expected to approximate 50% on an annualized basis;

- Consolidated net earnings was $9.1 million and $5.5 million for the three and six months ended June 30, 2024, respectively, compared to net earnings of $8.5 million and $13.2 million for the three and six months ended June 30, 2023, respectively. For the three months ended June 30, 2024, net earnings from continuing operations were $12.2 million compared to $8.9 million for the Q2 2023. The lower net earnings year-to-date was due to the loss from discontinued operations. The sale of the Modular business is expected to close in August 2024.

- Earnings per share from continuing operations was $0.19 in Q2 2024 and increased from $0.14 compared to the same quarter last year. Earnings per share from continuing operations for the six months ended June 30, 2024 and 2023 was $0.26 and $0.21, respectively; and

- Dexterra declared a dividend for Q3 2024 of $0.0875 per share for shareholders of record at September 30, 2024, to be paid on October 15, 2024.

This news release contains certain measures and ratios, such as Adjusted EBITDA, Adjusted EBITDA as a percentage of revenue, and Free Cash Flow, that do not have any standardized meaning as prescribed by GAAP and, therefore, are considered non-GAAP measures. The method of calculating these measures may differ from other entities and accordingly, may not be comparable to measures used by other entities. See “Non-GAAP measures” and “Reconciliation of Non-GAAP measures” of the Corporation’s MD&A for the three and six months ended June 30, 2024 for details which is incorporated by reference herein. Second Quarter Financial Summary

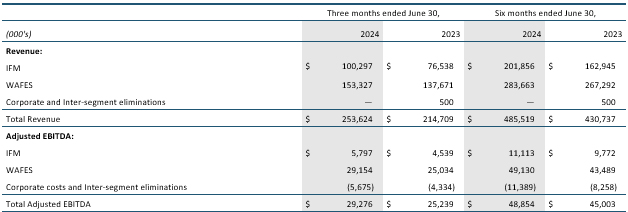

Second Quarter Operational Analysis

Integrated Facilities Management (“IFM”)

For Q2 2024, IFM revenues were $100.3 million, an increase of 31.0% from Q2 2023 primarily related to the acquisition of CMI which contributed $23.3 million, as well as the addition of new contracts across the IFM business and defence contract project work. Our pipeline of opportunities is also strong as we focus on delivering strong organic growth.

IFM Adjusted EBITDA for Q2 2024 was $5.8 million which was higher compared to $4.5 million of Adjusted EBITDA for Q2 2023. Adjusted EBITDA as a percentage of revenue for Q2 2024 was 5.8%, an improvement over 5.2% in Q1 2024. Improved Adjusted EBITDA and Adjusted EBITDA as a percentage of revenue resulted from managing inflationary costs, refining our mix of business, the positive impact from the CMI acquisition, partially offset by lower than normal food service event and conference activity at post-secondary universities due to campus protests. Adjusted EBITDA margins are expected to continue to improve through the balance of 2024.

Workforce Accommodations, Forestry and Energy Services (“WAFES”)

Revenue from the WAFES business for Q2 2024 was $153.3 million compared to $137.7 million in Q2 2023, an increase of 17.6% over Q1 2024 driven by strong market activity generally throughout the business. This was partly offset by lower wildfire support activity in Q2 2024 compared to Q2 2023. New large long-term contracts mobilized in Q1 2024 came fully on stream in Q2, replacing projects such as Coastal Gas Link (“CGL”) and LNG Canada. Adjusted EBITDA for Q2 2024 was $29.2 million compared to $25.0 million in Q2 2023 and $20.0 million in Q1 2024. Adjusted EBITDA margin for Q2 2024 was 19.0% compared to 18.2% for the same quarter last year and 15.3% in Q1 2024. The Adjusted EBITDA margin increase compared to the same quarter last year was primarily due to the aforementioned robust market activity which included greater than 90% camp, space rental, and access matting utilization, and inflationary price increases passed on to customers. Margins fluctuate based on activity level and mix of business.

For the six months ended June 30, 2024, revenue was $283.7 million, an increase of 6.1%, and Adjusted EBITDA was 13.0% higher compared to the same period in the prior year. Adjusted EBITDA year to date 2024 as percentage of revenue was 17.3%, compared to 16.3% in 2023.

Discontinued Operations (Modular Solutions)

Net loss from discontinued operations for Q2 2024 was $3.1 million compared to a net loss for Q2 2023 of $0.4 million. Modular revenues were $26.7 million for Q2 2024 compared to $53.1 million in Q2 2023 and $27.7 million in Q1 2024. Direct costs included in the loss on discontinued operations for Q2 2024 were $27.7 million and were impacted by costs related to the rework and remediation of certain challenged social affordable housing projects which are now substantially completed as well as lower overhead absorption due to the temporary decrease in revenue in Q2 2024. For the six months ended June 30, 2024, the net loss from discontinued operations was $11.1 million, an increase of $10.6 million compared to the same period in the prior year due to the reasons discussed above.

Liquidity and Capital Resources

Debt was $139.8 million at June 30, 2024, compared to $132.7 million at Q1 2024. The increase from Q1 2024 was due to normal seasonality in the business. For the six months ended June 30, 2024, FCF was significantly improved at $10.1 million. The improvement is primarily related to strong collections of receivables. The conversion of Adjusted EBITDA to FCF for 2024 for continuing operations is expected to be 50% on an annualized basis with Q3 and Q4 experiencing the highest conversions to FCF as a result of the seasonality of the WAFES and IFM business units.

In conjunction with the Gitxaala Horizon North Services Limited Partnership (owned 49% by Dexterra), 329 relocatable space rental units were sold in June 2024. The selling price of $20.5 million reflected the approximate net book value of the assets held as Dexterra proactively manages its capital investments and mix of assets. For the six months ended June 30, 2024, the Corporation made growth capital investments of $0.6 million net of the Gitxaala sale of equipment which is consistent with our strategic focus on providing capital light support services.

Additional Information

A copy of Dexterra’s Condensed Consolidated Interim Financial Statements (“Financial Statements”) for the three and six months ended June 30, 2024 and 2023 and related Management’s Discussion and Analysis (“MD&A”) have been filed with the Canadian securities regulatory authorities and are available on SEDAR at sedarplus.ca and Dexterra’s website at dexterra.com. The Financial Statements have been prepared in accordance with International Financial Reporting Standards and the reporting currency is in Canadian dollars.

Conference Call

Dexterra will host a conference call and webcast to begin promptly at 8:30 Eastern time on August 7, 2024 to discuss the second quarter results.

To access the conference call by telephone the conference call dial in number is 1-844-763-8274.

A live webcast of the conference call will be accessible on Dexterra Group’s website at dexterra.com/investor-presentations-events/ by selecting the Q2 2024 Results webcast link. An archived recording of the conference call will be available approximately one hour after the completion of the call until September 7, 2024 by dialing 1-855-669-9658, passcode 2204940#.

About Dexterra

Dexterra employs more than 9,000 people, delivering a range of support services for the creation, management, and operation of infrastructure across Canada and the USA.

Powered by people, Dexterra brings best-in-class regional expertise to every challenge and delivers innovative solutions, giving clients confidence in their day-to-day operations. Activities include a comprehensive range of facilities management services, industry-leading workforce accommodation solutions and other support services for diverse clients in the public and private sectors.

For further information contact:

Denise Achonu, CFO

Head office: Airway Centre, 5915 Airport Rd., 4th Floor, Mississauga, Ontario, L4V 1T1

Telephone: (905) 270-1964

You can also visit our website at dexterra.com

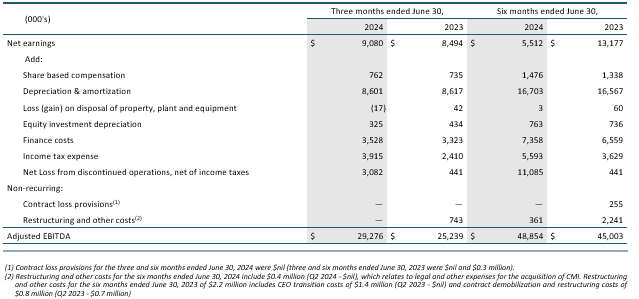

Reconciliation of non-GAAP measures

The following provides a reconciliation of non-GAAP measures to the nearest measure under GAAP for items presented throughout the News Release.

Adjusted EBITDA

Free Cash Flow

Forward-Looking Information

Certain statements contained in this news release may constitute forward-looking information under applicable securities law. Forward-looking information may relate to Dexterra’s future outlook and anticipated events, business, operations, financial performance, financial condition or results and, in some cases, can be identified by terminology such as “continue”; “forecast”; “may”; “will”; “project”; “could”; “should”; “expect”; “plan”; “anticipate”; “believe”; “outlook”; “target”; “intend”; “estimate”; “predict”; “might”; “potential”; “continue”; “foresee”; “ensure” or other similar expressions concerning matters that are not historical facts. In particular, statements regarding Dexterra’s future operating results and economic performance, including return on equity and Adjusted EBITDA margins; reorganization of the the existing business; its capital light model management, market and inflationary environment expectations, lodge occupancy levels, its leverage, Discontinued Operations, expected closing of the sale of the Modular business, Free Cash Flow, wildfire activity expectations and its objectives and strategies are forward-looking statements. These statements are based on certain factors and assumptions, including expected growth, market recovery, results of operations, performance and business prospects and opportunities regarding Dexterra, the satisfaction of conditions for the sale of the Modular business which Dexterra believes are reasonable as of the current date. While management considers these assumptions to be reasonable based on information currently available to Dexterra, they may prove to be incorrect. Forward-looking information is also subject to certain known and unknown risks, uncertainties and other factors that could cause Dexterra’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward- looking information, including, but not limited to: the ability to retain clients, renew existing contracts and obtain new business; an outbreak of contagious disease that could disrupt its business; the highly competitive nature of the industries in which Dexterra operates; reliance on suppliers and subcontractors; cost inflation; volatility of industry conditions could impact demand for its services; a reduction in the availability of credit could reduce demand for Dexterra’s products and services; Dexterra’s significant shareholder may substantially influence its direction and operations and its interests may not align with other shareholders; its significant shareholder’s 49% ownership interest may impact the liquidity of the common shares; cash flow may not be sufficient to fund its ongoing activities at all times; loss of key personnel; the failure to receive or renew permits or security clearances; significant legal proceedings or regulatory proceedings/changes; environmental damage and liability is an operating risk in the industries in which Dexterra operates; climate changes could increase Dexterra’s operating costs and reduce demand for its services; liabilities for failure to comply with public procurement laws and regulations; any deterioration in safety performance could result in a decline in the demand for its products and services; failure to realize anticipated benefits of acquisitions and dispositions; inability to develop and maintain relationships with Indigenous communities; the seasonality of Dexterra’s business; inability to restore or replace critical capacity in a timely manner; reputational, competitive and financial risk related to cyber-attacks and breaches; failure to effectively identify and manage disruptive technology; economic downturns can reduce demand for Dexterra’s services; its insurance program may not fully cover losses. Additional risks and uncertainties are described in Note 22 of the Corporation’s Consolidated Financial Statements for the year ended December 31, 2023 and 2022 contained in its most recent Annual Report filed with securities regulatory authorities in Canada and available on SEDAR at sedarplus.ca. The reader should not place undue importance on forward-looking information and should not rely upon this information as of any other date. Dexterra is under no obligation and does not undertake to update or alter this information at any time, except as may be required by applicable securities law.