Toronto, Ontario — (Newsfile Corp. – May 9, 2023) – Dexterra Group Inc. (TSX: DXT)

Highlights

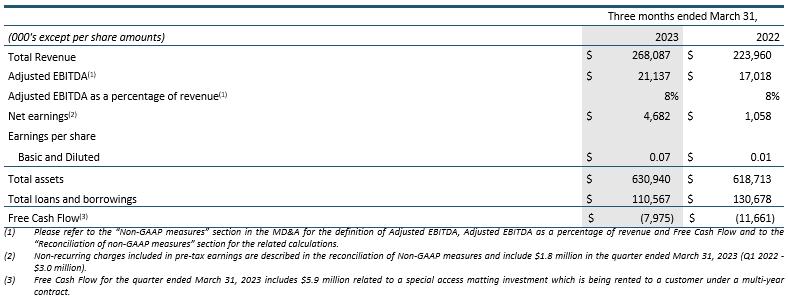

- Consolidated revenue totaled $268.1 million for Q1 2023 which was an increase of 20% compared to Q1 2022 and 6% compared to Q4 2022. Increased revenue is primarily related to the continued growth in IFM and strong growth in workforce accommodations in Ontario and Quebec;

- The Corporation’s Adjusted EBITDA for Q1 2023 was $21.1 million which was an increase of 24% compared to Q1 2022 and 51% compared to Q4 2022 reflecting stronger margins in IFM, including normalized margins in the Dana food service business, and improved Modular results;

- Consolidated net earnings of $4.7 million for Q1 2023 compared to $1.1 million in Q1 2022 and a net loss of $2.9 million in Q4 2022. The increase is attributable to the overall improved results across all business units and a reduction in non-recurring expenses;

- The Corporation acquired VCI Controls Inc. (“VCI”) on January 31, 2023 for $4.2 million including holdback of $1.0 million. The acquisition adds to Dexterra’s building and automation controls capability which is a key capability as clients focus on ESG requirements, energy efficiency and carbon footprint reductions;

- Dexterra announced a Normal Course Issuer Bid (“NCIB”) commencing on May 15, 2023, as the Corporation believes that a share buyback program provides a superior investment opportunity; and

- Dexterra declared a dividend for Q2 2023 of $0.0875 per share for shareholders of record at June 30, 2023, to be paid July 17, 2023.

This news release contains certain measures and ratios, such as Adjusted EBITDA, Adjusted EBITDA as a percentage of revenue, IFM Adjusted EBITDA as a percentage of revenue, excluding certain loss contracts, Free Cash Flow and backlog, that do not have any standardized meaning as prescribed by GAAP and, therefore, are considered non-GAAP measures. The method of calculating these measures may differ from other entities and accordingly, may not be comparable to measures used by other entities. See “Non-GAAP measures” and “Reconciliation of Non-GAAP measures” of the Corporation’s MD&A for the three months ended March 31, 2023 and 2022 for details which is incorporated by reference herein.

First Quarter Financial Summary

First Quarter Operational Analysis

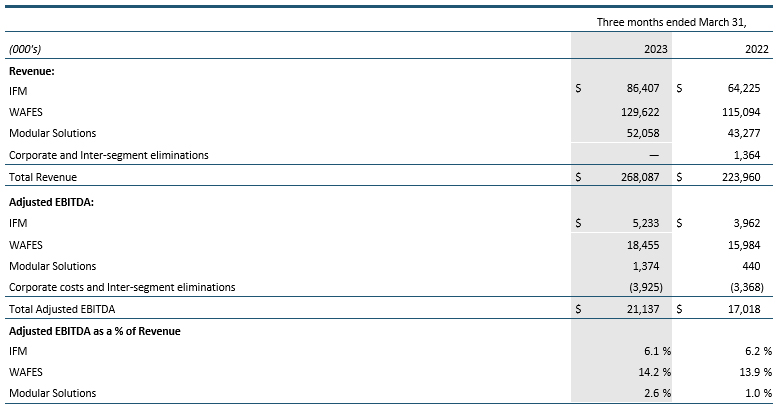

Integrated Facilities Management (“IFM”)

For Q1 2023, IFM revenues were $86.4 million, an increase of 35% from Q1 2022 and 10% from Q4 2022. The increase is the result of new contracts and includes the results of the 2022 IFM Acquisitions which occurred in January 2022. The 2022 IFM Acquisitions continue to expand their footprint and contributed $37 million in revenue for Q1 2023 with strong margins compared to $25 million in revenue in Q1 2022. Business activity levels increased with no COVID-19 restrictions and the education sector returning to normal operations.

The increased Q1 2023 IFM Adjusted EBITDA of $5.2 million compared to $4.0 million for Q1 2022 and $2.8 million for Q4 2022 is primarily due to the execution of the 2023 business plan which included proactively addressing inflation and labour availability issues and improving Dana profitability. Adjusted EBITDA as a percentage of revenue, excluding loss contracts, increased from 5.9% in Q4 2022 to 6.4% in Q1 2023.

Workforce Accommodations, Forestry and Energy Services (“WAFES”)

Revenue from the WAFES business unit for Q1 2023 was $129.6 million, an increase of 13% compared to Q1 2022 and a 5% increase compared to Q4 2022. This increase in revenue is primarily from new projects and high activity in the mining sector compared to the same period in 2022. The Energy Services division also continues to experience high activity levels. For the three months ended March 31, 2023, WAFES support services activity accounted for 46% (54% asset-based services) of total WAFES revenue compared to 41% support services (59% asset-based services) for the same period in 2022. The Q1 2023 Adjusted EBITDA as a percentage of revenue was 14%, which is consistent with Q1 2022 and lower than the 17% in Q4 2022 which included retroactive price increases of $2.8 million.

Modular Solutions

Modular Solutions business unit revenues for Q1 2023 were $52.1 million which was up by $8.8 million compared to the $43.3 million in Q1 2022 and consistent with Q4 2022. Adjusted EBITDA for Q1 2023 was $1.4 million, compared to $0.4 million in Q1 2022 and a loss of $6.6 million in Q4 2022. The improvement in profitability from the last quarter is the result of the continued execution of the four-point business turnaround plan. Q4 2022 results included an $8 million special provision for the costs to complete certain British Columbia (“BC”) social affordable housing projects. Revenue in Q1 2023 included $13.6 million for these projects which delivered as expected a $nil margin and the remaining backlog of $35 million is expected to be completed in Q2 and Q3 of 2023.

The pace of modular profitability recovery in 2023 will be related to the timing of approvals for new social affordable housing projects and the lower demand for US supply-only projects.

Liquidity and Capital Resources

The conversion of EBITDA to Free Cash Flow for 2023, excluding any special non-recurring items, is expected to approximate 50%.

Debt was $110.6 million at March 31, 2023 compared to $94.0 million at Q4 2022. The increase is due to additional working capital investments related to the expansion of the business, the cash paid on the VCI acquisition of $3.2 million and the special access matting investment of $5.9 million. The Corporation’s financial position and liquidity remain strong with $78.1 million unused capacity on its credit lines at March 31, 2023.

Additional Information

A copy of Dexterra’s Condensed Consolidated Interim Financial Statements (“Financial Statements”) for the three months ended March 31, 2023 and 2022 and related Management’s Discussion and Analysis (“MD&A”) have been filed with the Canadian securities regulatory authorities and are available on SEDAR at sedar.com and Dexterra’s website at dexterra.com. The Financial Statements have been prepared in accordance with International Financial Reporting Standards and the reporting currency is in Canadian dollars.

Conference Call

Dexterra will host a conference call and webcast to begin promptly at 8:30 Eastern time on May 10, 2023 to discuss the first quarter results.

To access the conference call by telephone the conference call dial in number is 1-800-806-5484.

A live webcast of the conference call will be accessible on Dexterra Group’s website at dexterra.com/investor-presentations-events/ by selecting the webcast link. An archived recording of the conference call will be available approximately one hour after the completion of the call until June 10, 2023 by dialing 1-800-408-3053, passcode 7906982#.

About Dexterra

Dexterra employs more than 8,500 people, delivering a range of support services for the creation, management, and operation of infrastructure across Canada.

Powered by people, Dexterra brings best-in-class regional expertise to every challenge and delivers innovative solutions, giving clients confidence in their day-to-day operations. Activities include a comprehensive range of integrated facilities management services, industry leading workforce accommodation solutions, innovative modular building capabilities, and other support services for diverse clients in the public and private sectors.

For further information contact:

Drew Knight, CFO

Head office: Airway Centre, 5915 Airport Rd., 4th Floor Mississauga, Ontario L4V 1T1

Telephone: (416) 767-1148

You can also visit our website at dexterra.com.